When a Disability Claim Can Last for Decades Who Can You Count on to Pay It?

Financial stability is a must for any insurance company – and particularly essential for carriers who will have to pay long-term benefits like disability. When choosing a carrier, it’s important to look for a company with a demonstrated record of financial strength.

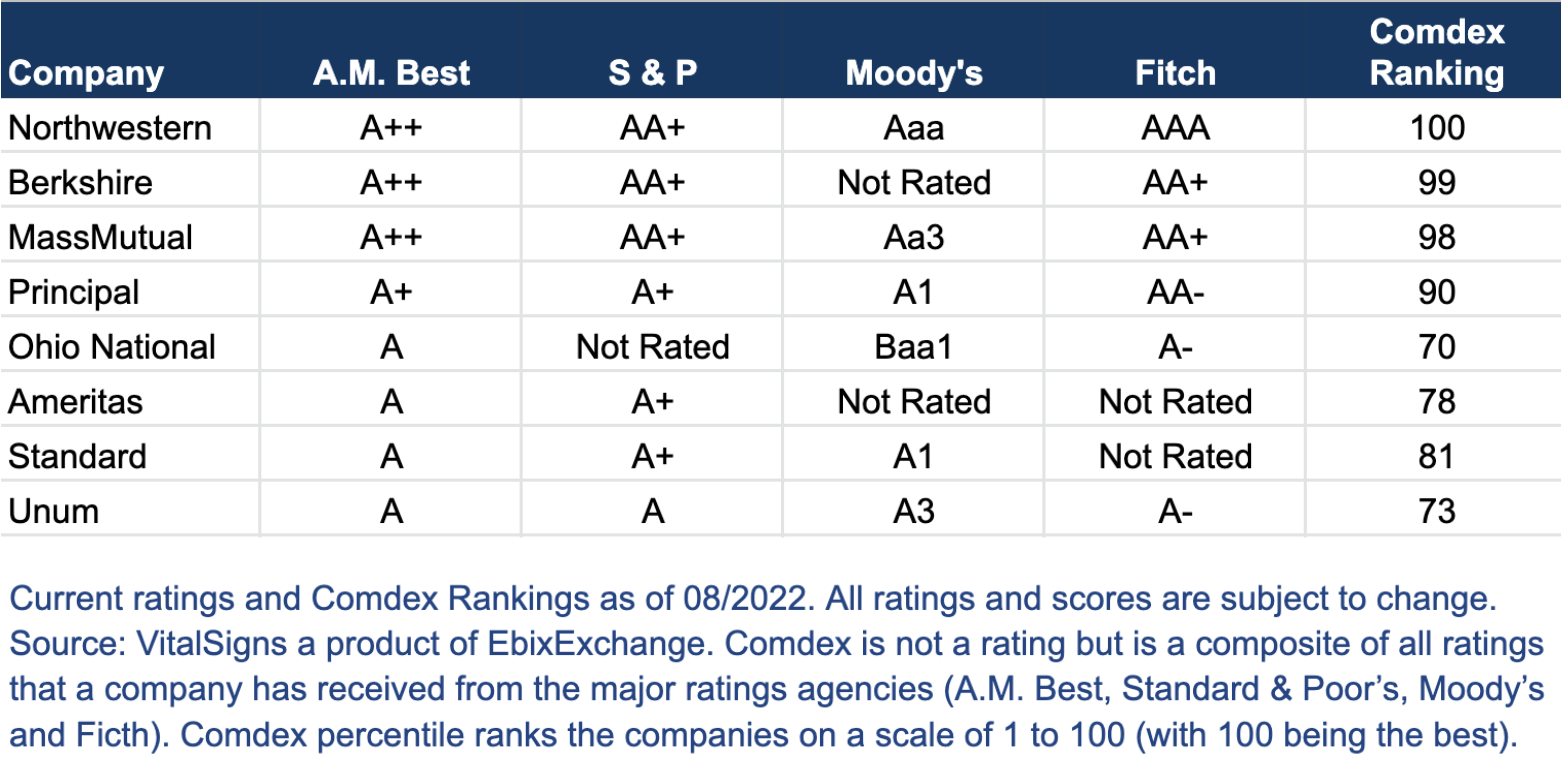

Exemplary Ratings and Comdex Ranking

One of the best ways to evaluate an insurance company is to look at how it compares to other insurance carriers. Independent third-party rating services like A.M. Best, Fitch, Moody’s, and Standard & Poor’s provide objective ratings of financial strength.

Each rating agency has a different rating scale, thus looking at these ratings individually is not as important as looking at how a given company looks relative to others.

A composite of the various ratings a company has received is called the Comdex Ranking. This is not a rating but is a percentile ranking on a scale of 1 to 100 (with 100 being the best) in relation to other companies that have been evaluated by at least two of the four rating agencies.

The following table reflects the independent agencies' ratings for the companies listed as well as the composite of those ratings reflected in the Comdex Ranking.

Top Ratings Do Not Mean The Right Policy

Having superior financial ratings is very important because it does show a company's ability to pay a claim for the long term. You must keep in mind that a company can have excellent ratings and still offer a less than attractive policy. It is the language in the policy itself that determines whether or not an individual disability insurance policy is going to pay benefits during an accident or illness. When you buy disability insurance you should evaluate the provisions of the policy first, and then once you have found the best contract for you make sure the company has excellent financial ratings to back it up.