DI Protection just for Physicians

A Game Changer

As a leading provider of individual disability insurance (DI) for physicians, we understand your unique needs when it comes to income protection. That knowledge shaped the development of a special disability policy just for physicians that is raising the bar for what you can expect when it comes to DI.

True own-occupation protection

True own-occupation protection

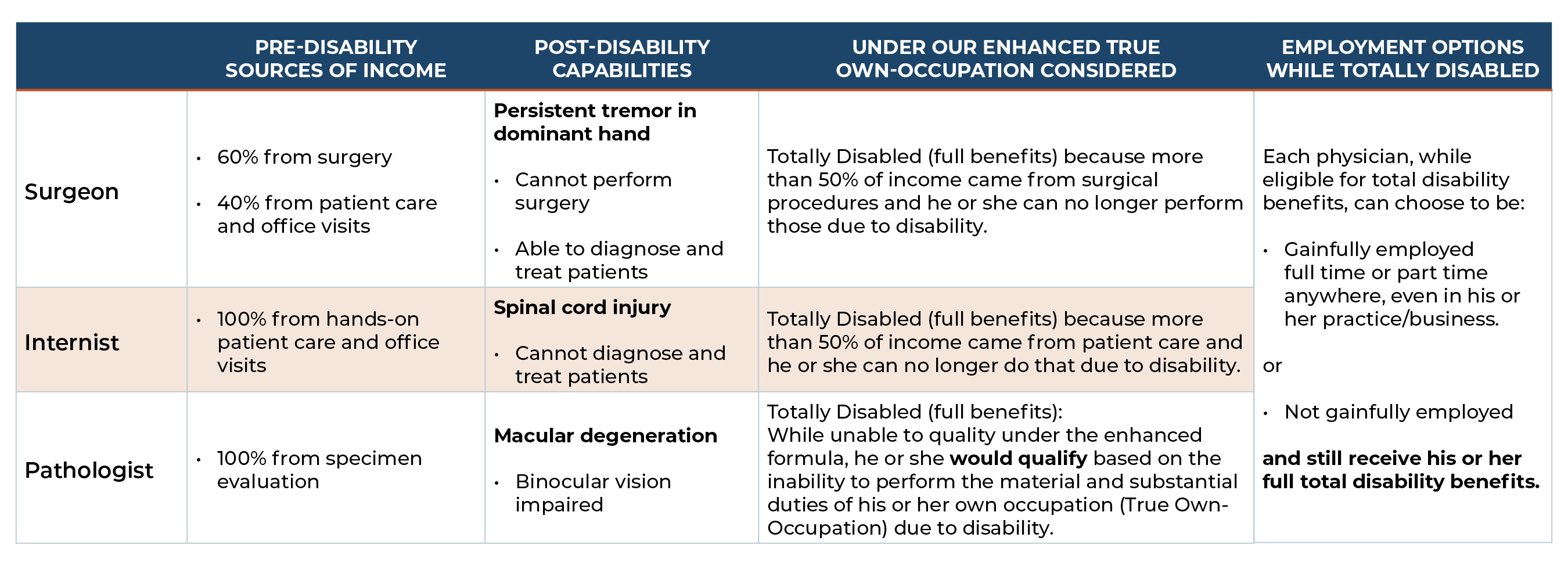

Our Enhanced True Own-Occupation protection1 just for physicians and doctors of osteopathy starts with our strong True Own-Occupation Definition of Total Disability. If totally disabled, you’re able to receive your full disability benefits even if you’re gainfully employed in another occupation or capacity. And, while totally disabled in your own occupation, there may be instances where you can even work in your own business or practice and still collect your full disability benefit.

Plus more ways to qualify for benefits

Then, we add a straightforward, easy-to-understand formula to qualify for benefits. It’s based on your source of earnings and provides more ways to qualify for benefits. We’ll consider you totally disabled if more than 50% of your income is from

- Hands-on patient care and, solely because of injury or illness, you can no longer perform hands-on patient care; or

- Performing surgical procedures and, solely because of injury or illness, you can no longer perform surgical procedures.

That’s not all. If you don’t qualify for benefits under the source-of-earnings formula above, then we’ll look at your key duties, including those you were performing in your medical specialty at the time your disability began, to assess whether or not you qualify. Because we evaluate your situation from multiple perspectives, we give you more ways to qualify for total disability benefits.

Base policy:

Base policy: