What is the Benefit Period?

The Benefit Period is the maximum length of time a policy will pay benefits for continuous disability. If you choose the option To Age 65 and are continuously disabled at age 40, you would be paid every month for the next 25 years. The Provider Choice disability insurance policy offers several different options to choose from:

- To Age 65

- To Age 67

- To Age 70

- Graded Lifetime Benefits

- 10 Years

- 5 Years

- 2 Years

How Do I Know Which Option to Use?

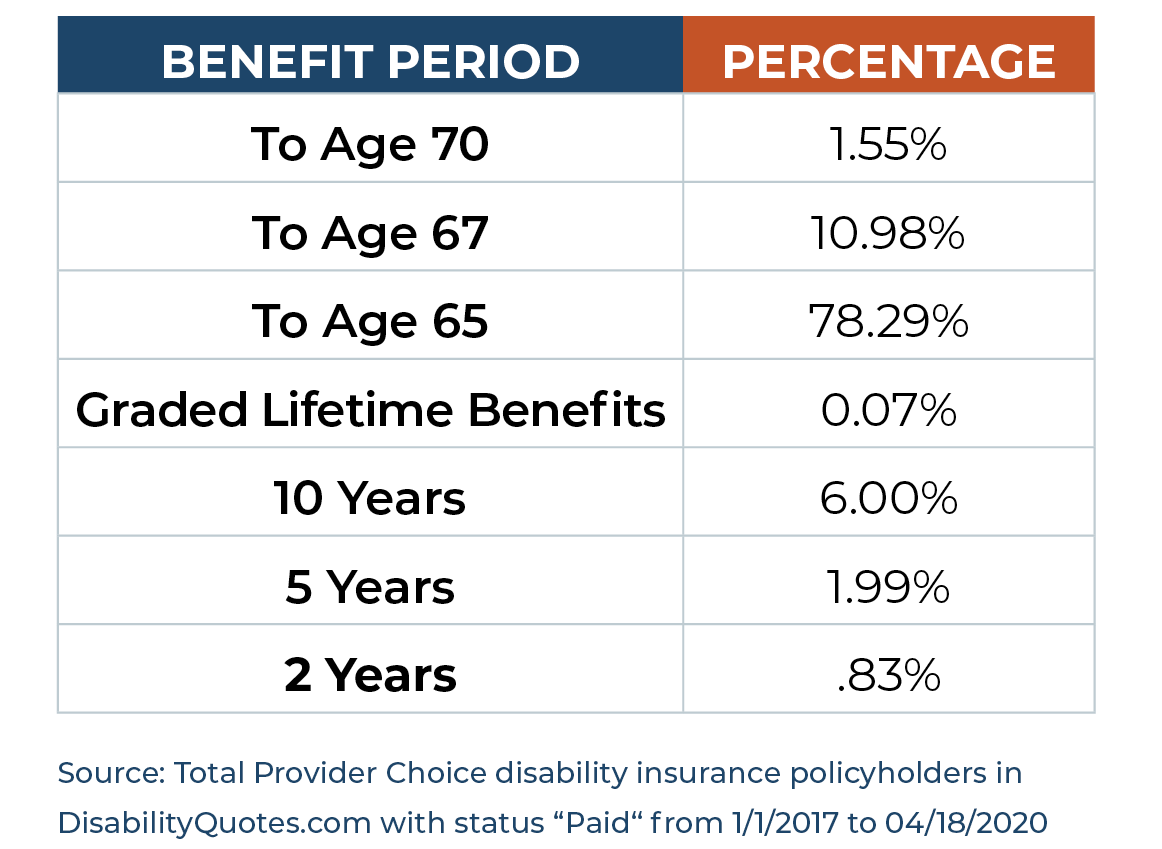

The following data shows what percentage of people purchased each benefit period over a recent three-year period. As you can see there is a clear number one choice.

The following data shows what percentage of people purchased each benefit period over a recent three-year period. As you can see there is a clear number one choice.

Benefit Period to Age 65

As you can see from the table above, 78.29% of people who purchase a policy select the “To Age 65” benefit period. It is clearly the most common choice. However, the new “To Age 67” and the "To Age 70" benefit periods have only been around for a few years. Agents have habits just like anybody else, and most agents have been used to selling "To age 65" benefits for decades. We predict as more people make plans to have longer careers the longer options will become more popular.

One never knows if they will ever suffer a long-term disability, or what it is that might cause the disability. If we did, then we would know exactly what type of

One never knows if they will ever suffer a long-term disability, or what it is that might cause the disability. If we did, then we would know exactly what type of