Which Riders Should I Choose?

Which Riders Should I Choose?

We have been focusing on the sale of individual disability insurance since 1997. Helping tens of thousands of clients protect their income. One question that comes up frequently when advising consumers on how to design their coverage is “What optional riders should I have on my policy?”

Optional riders can add further value to an already strong core product. They can help make sure that the coverage;

- keeps pace with inflation

- protects against partial disabilities

- allows the opportunity to buy more coverage without medical questions in the future.

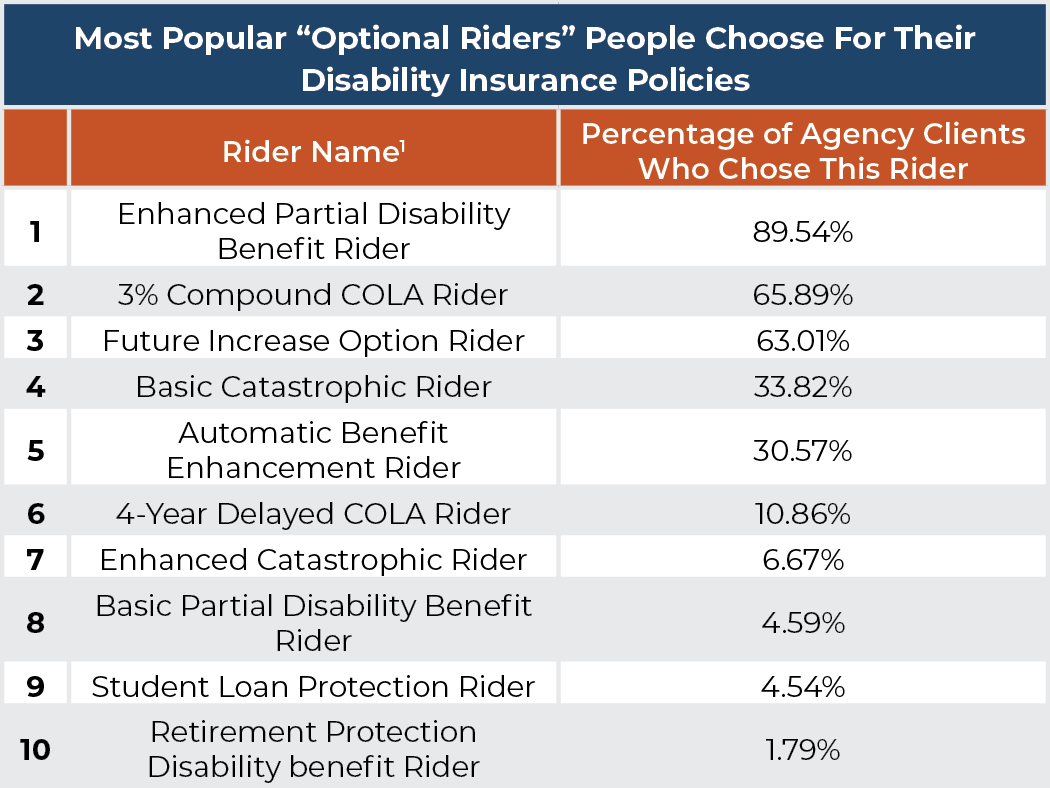

Almost all of our clients chose to include certain optional riders on their policies. The following list shows you exactly which riders our current policyholders have chosen to include on their policies, and what percentage of people chose each one.

The Partial Disability Benefit Rider

The data shown are compiled from actual sales of individual disability insurance policies to clients from the past decade and accounts for over 31,000 policies sold during that time. As you can see, almost all of our clients chose some form of the Partial Disability Benefit Rider. In our opinion, this is one of the most important features of any policy. Without one of these riders, you would only be eligible for benefits if you are totally disabled.

By adding the basic or enhanced partial disability benefit rider, your policy can protect you from an illness or injury that doesn't cause a total disability but does limit your ability to work. For basic partial, you must suffer a loss of time and/or duties, and a 20% loss of income or more. Enhanced partial will pay benefits as long as you suffer a loss of income of 15% or more due to disability. The enhanced partial can even assist you in recovering from a total disability when you have returned to work full time but continue to suffer at least a 15% loss of income.

Another popular rider is the

Another popular rider is the

This optional rider does not necessarily protect against an increase in the cost of living.

This optional rider does not necessarily protect against an increase in the cost of living.