The Right Type of Disability Income Protection

There is a correct type of disability insurance for physicians. This is known as medical-specialty own occupation disability insurance. While many jobs don’t benefit from own-occupation coverage, physicians, especially highly trained physicians such as surgeons, do benefit from this special type of coverage. In order to understand why medical-specialty own occupation coverage is, it’s helpful to recap the options. These are the different types of definitions that are available in a disability insurance policy:

- Any Occupation – This type of policy pays you if, due to injury or sickness, you can’t do any occupation in the general workforce. It is typically the least desirable by highly skilled occupations, as it will only pay benefits if you are unable to do any type of job.

- Modified Own Occupation – This type of policy is often presented by many agents as “own occupation” coverage, but it’s not. It states that benefits will be paid if, due to injury or sickness, you are unable to do the duties of your own occupation, AND you’re not engaged in any other occupation. Under this type of policy, if you can’t do your own occupation, and you chose to do something else, your benefits are either reduces or eliminated based on your income in your new job.

- Own Occupation – Until recently, this was the best definition of disability that one could buy. It states that benefits will be paid if, due to injury or sickness, you are unable to do the duties of your own occupation, even if you are engaged in another occupation. By continuing to pay benefits in addition to income earned in a new profession, you are more likely to get back to your pre-disability income levels. For many occupations, this is still the gold standard in coverage.

Medical Specialty Own Occupation

Also known as Enhanced True Own Occupation coverage, this type of policy is what physicians should be purchasing.

- It starts with the Own Occupation definition of disability - If totally disabled, you’re able to receive your full disability benefits even if you’re gainfully employed in another occupation or capacity.

- It then adds another layer of security by stating that you will be considered totally disabled, if more than 50% of your income is from hands-on patient care and, solely because of injury or illness, you can no longer perform hands-on patient care; or if more than 50% of your income is from performing surgical procedures and, solely because of injury or illness, you can no longer perform surgical procedures.

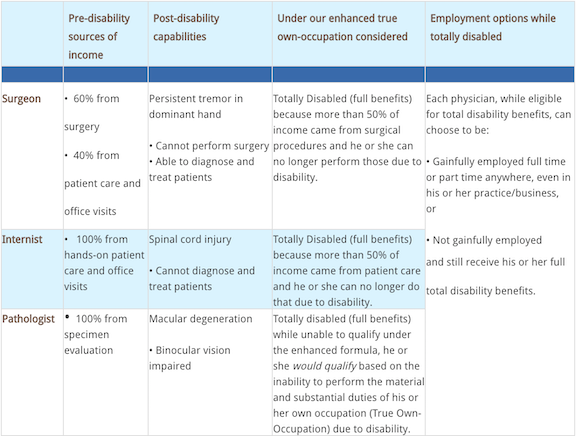

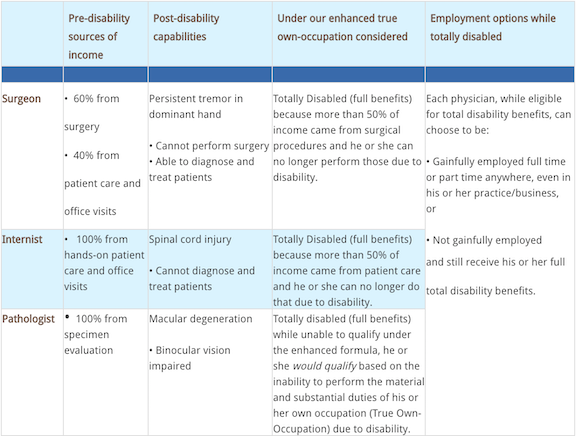

Here are some examples of where the Enhanced True Own Occupation definition of disability is beneficial for different medical specialties:

Here are some examples of where the Enhanced True Own Occupation definition of disability is beneficial for different medical specialties:

When you’re buying a disability insurance policy to protect your income, you’re buying a promise to pay you in the event you cannot do your job. That promise is only as strong as the contractual language in the policy. Physicians looking to protect substantial income should purchase the strongest contractual definitions possible in the policy, which today is the Enhanced True Own Occupation definition of disability.

Use the Future Increase Option

In addition to getting the right definition of disability in your policy, physicians also need to structure the other features of the policy in the correct way to provide value and protect future income and obligations. Most physicians, even neurosurgeons, don’t start off making $663,000 per year. It takes time to come out of residency, fellowship, join a practice, become a partner, etc. Don’t wait until you feel like you have a substantial income to protect. Buy the right type of disability insurance policy when you’re young, healthy, and let it grow with you over time.

You can do this through the use of future increase options (FIO). An FIO rider allows you to increase your disability insurance benefits as your income increases. A physician in residency can buy $5,000/mo in disability insurance and include future increase options so that they will not have to go back through medical underwriting and answer any health questions when they want to increase coverage.

Disability insurance is bought when one is in good health. By including a future increase option rider on your policy, you can lock in your good health and continue to be eligible to increase your disability insurance as your income increases.

A disability early in the career of a physician can have unique and devastating consequences. Unlike some occupations that graduate and begin earning income quickly, and have little to no debt, many physicians graduate with significant amounts of student loan debt.

A disability early in the career of a physician can have unique and devastating consequences. Unlike some occupations that graduate and begin earning income quickly, and have little to no debt, many physicians graduate with significant amounts of student loan debt.

According to the Association of American Medical Colleges, 79% of medical students graduate with more than $100,000 in student loan debt, and the average debt balance is now over $175,0002. Unlike other kinds of debt, federal student loans are not discharged during bankruptcy. This can create a serious problem for young physicians who had planned on repaying those loans with their earned income. However, they may find themselves unable to earn that significant income due to a disability early in their career. The solution is to include a feature on the physician disability insurance policy that helps repay these loans in the event of a disability. Up to $2,500 per month can be added to the disability insurance policy for the specific purpose of repaying the student loans over a period of either 10 or 15 years.

Just like it’s important that patients go to the right specialist for their situation, it’s important that physicians go to the right specialist for their disability insurance. The vast majority of insurance agents do not specialize in this type of protection. Going to your local Allstate or Nationwide agent for disability insurance is similar to going to a primary care physician when you need to be seen by a neurologist. Disability insurance policies are highly technical types of contracts that require someone who is familiar with their language. The options in the marketplace change frequently, and unless you’re up to date on these changes, you may be costing yourself a lot of money. You don’t want to find out that you didn’t get the right definition of disability or didn’t get a particular feature or rider when you’re trying to file a claim. When you’re looking to protect an asset worth $8,000,000 - $13,000,000, it’s critical to get the best advice and do it the right way the first time.

Doximity Report

Doximity Report

https://web.archive.org/web/20150905144531/https://www.aamc.org/download/152968/data

https://web.archive.org/web/20150905144531/https://www.aamc.org/download/152968/data

Individual disability insurance policy Forms 18ID, 18UD, and 18GI are underwritten and issued by Berkshire Life Insurance Company of America, Pittsfield, MA, a wholly-owned stock subsidiary of The Guardian Life Insurance Company of America, New York, NY. Product provisions and availability may vary by state. In New York: These policies provide disability insurance only. They do not provide basic hospital, basic medical, or major medical insurance as defined by the New York State Insurance Department. For policy form 18ID, the expected benefit ratio is 50%. For policy forms 18UD, 18GI, 18UD-F, and 18GI-F, the expected benefit ratio is 60%. The expected benefit ratio is the portion of future premiums that the company expects to return as benefits when averaged over all people with these policy forms.

This material contains the current opinions of the author but not necessarily those of Guardian or its subsidiaries and such opinions are subject to change without notice.

Here are some examples of where the Enhanced True Own Occupation definition of disability is beneficial for different medical specialties:

Here are some examples of where the Enhanced True Own Occupation definition of disability is beneficial for different medical specialties: A disability early in the career of a physician can have unique and devastating consequences. Unlike some occupations that graduate and begin earning income quickly, and have little to no debt, many physicians graduate with significant amounts of student loan debt.

A disability early in the career of a physician can have unique and devastating consequences. Unlike some occupations that graduate and begin earning income quickly, and have little to no debt, many physicians graduate with significant amounts of student loan debt.